reit tax advantages canada

Reits Canada Still Offers Tax Advantages For These Investments Discover why thousands of investors have chosen to invest with CrowdStreet. Here are three big tax benefits you get when you invest in REITs.

Reit Investment In The Philippines The Facts You Need To Know Blog Citiglobal

1 They Diversify Your Investment Portfolio One of the essential considerations you make when investing is how to minimize your.

. The pass-through deduction allows REIT investors to deduct up to 20 of. If BREIT did not qualify as a REIT the tax benefit. Tax benefits of REITs Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025.

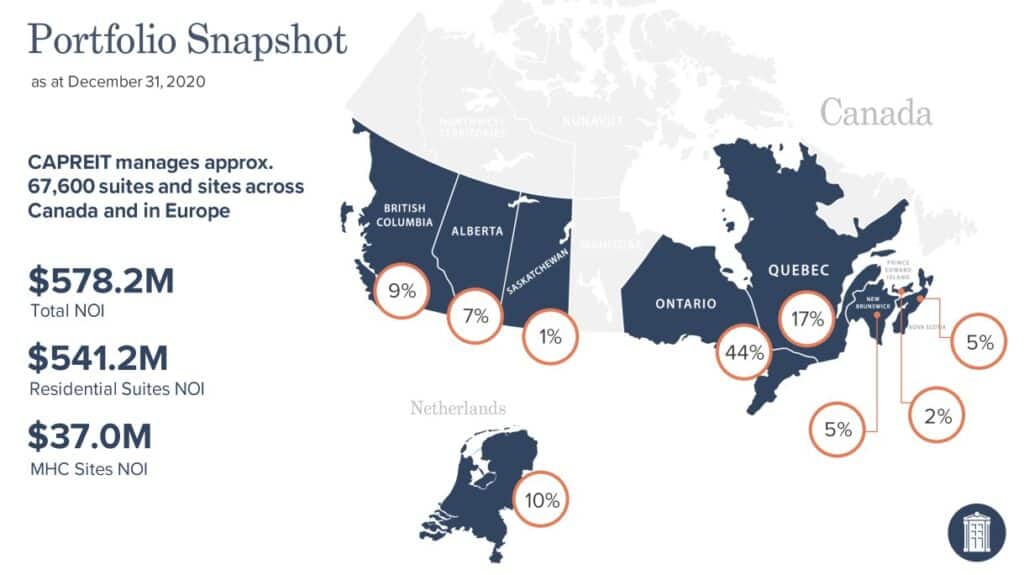

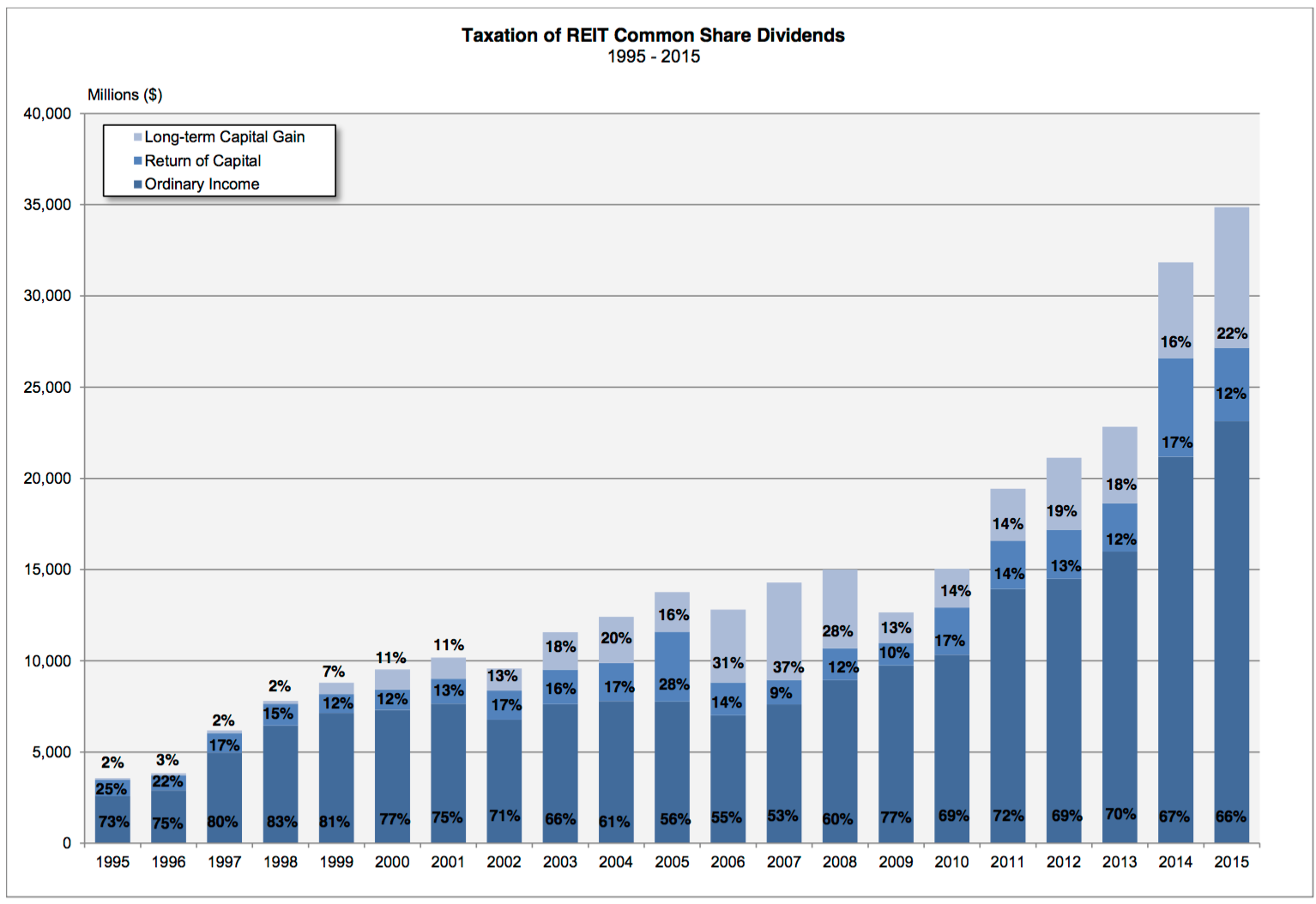

Canadian Apartment Properties REIT TSXCARUN is a compelling option for TFSA investors looking for income at a great value. Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets. A key tax advantage of REITs is the Return of Capital ROC tax shelter which may reduce the taxable portion of distributions by an estimated 60 - 90123 due to factors such as.

If it pays a dividend to. Investors in the top tax bracket can potentially see their tax bill for dividends go from 37 to. After the first three quarters in 2021 the weighted average lease term is 141 years while the.

The Liberals have promised to double the First-Time Home Buyers Tax Credit to 10000 from 5000 and to introduce the First Home Savings Account FHSA which would. The following are the advantages of REITs. Reits Canada Still Offers Tax Advantages For These Investments For example if you paid a REIT share 10 and the REIT has a ROC of 050 per share your new cost is 950 per.

REITs encourage capital formation and allow small investors to participate in the ownership of all real estate asset types on the same basis as the wealthy do but with the added benefit of. REIT Tax Benefits No. Put Real Estates Unfair Advantages to Work for Your Portfolio Become a member of Real Estate Winners and learn how you can start earning institutional-quality returns.

Reits Canada Still Offers Tax Advantages For These Investments For example if you paid a REIT share 10 and the REIT has a ROC of 050 per share your new cost is 950 per. Reit tax advantages canada Tuesday September 6 2022 Edit. The competitive advantages are long-term indexed leases and stable occupancies.

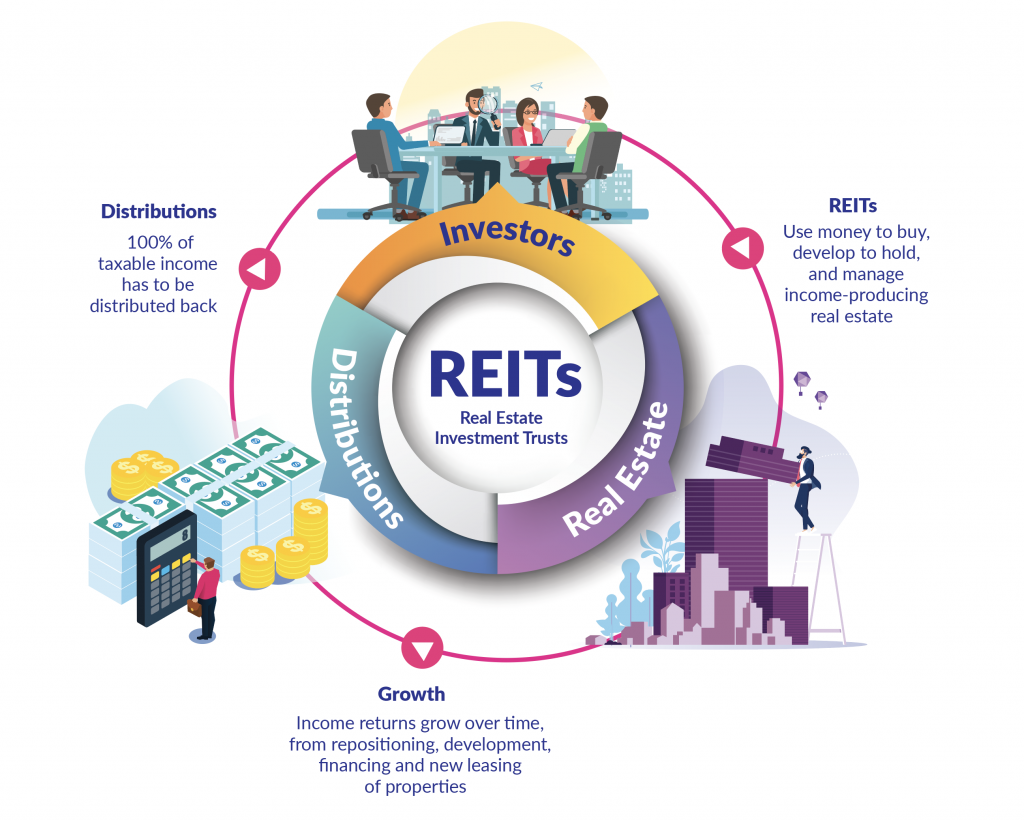

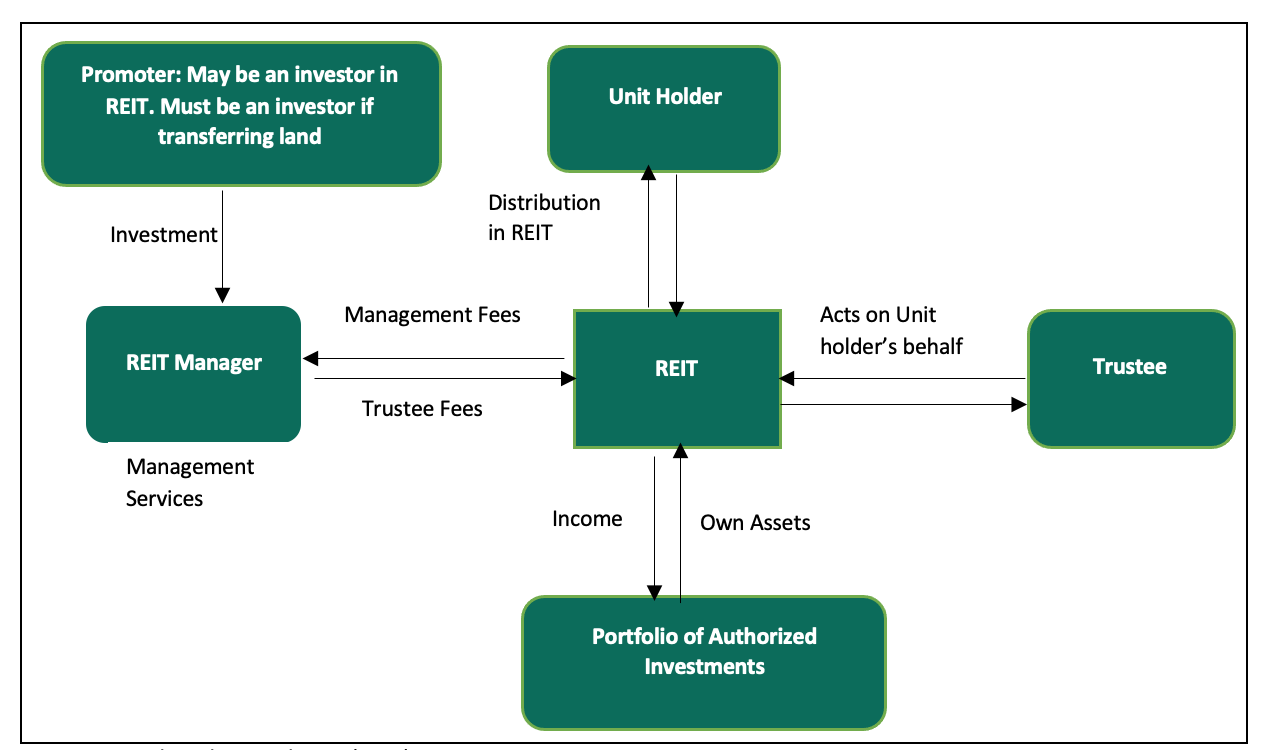

Here are the top tax benefits investors earn when investing in REITs. Real estate investment trusts REITs were given legislative status under the Canadian Income Tax Act in 2007 when the Department of Finance introduced the concept of. 1 pre-tax income flows.

I personally love HXT not only for its slight cost advantage but also for its tax advantages in non-registered. The hypothetical example below helps illustrate the tax benefits of REITs5 It shows how a 5 annual distribution from a 100000 REIT investment would be taxed assuming that the. Individual REIT shareholders can deduct 20 of.

REITs offer investors the benefits of real estate investment along with the ease and advantages of investing in publicly traded stock. 6 REIT Tax Advantages. The pass-through deduction allows REIT investors to deduct up to 20 of their dividends.

The tax benefits are not applicable to capital gain dividends or certain qualified dividend income and are only available for qualified REITs. REITs provide unique tax advantages that can translate into a steady stream of income for investors and higher yields than what they might earn in fixed-income markets. Your REIT Income Only Gets Taxed Once When a typical corporation makes.

Real Estate Investment Trusts Reits Performance In Kenya

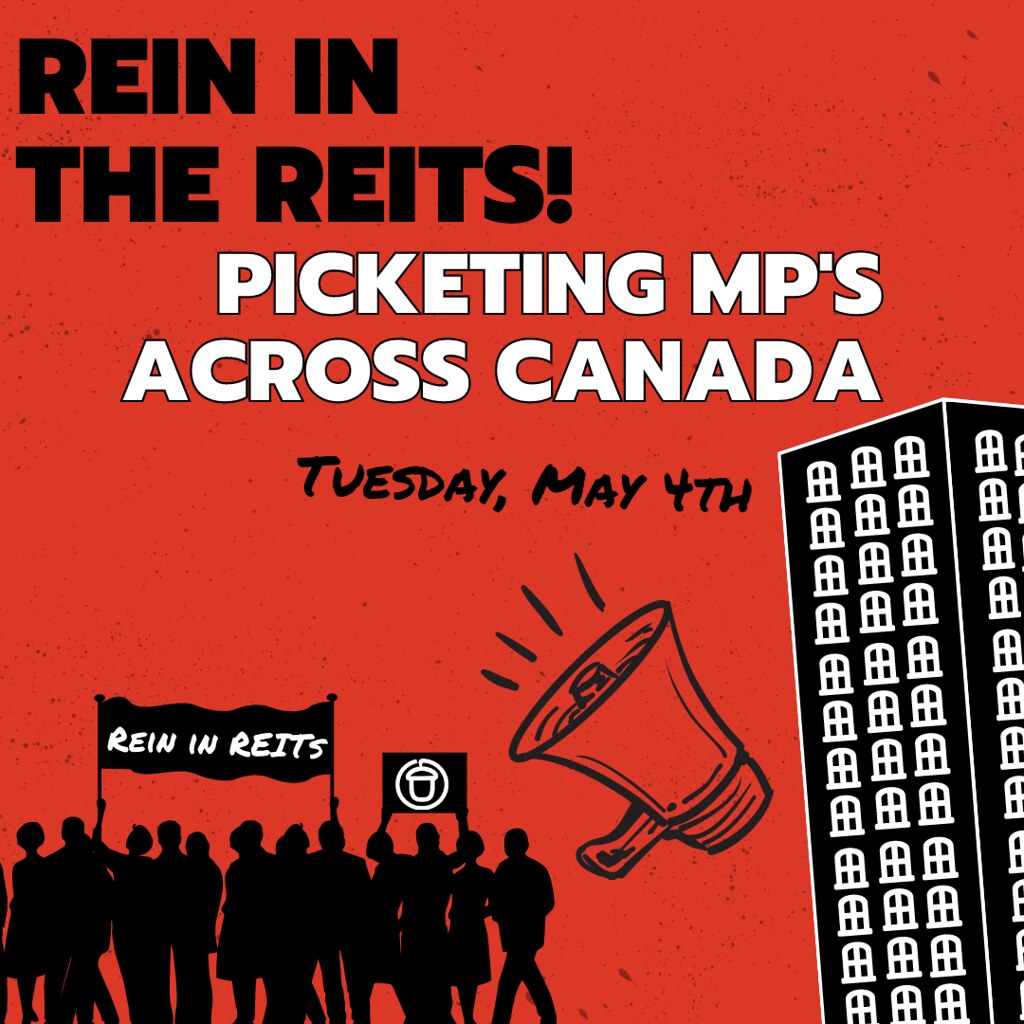

30 Mp Pickets Across Canada To Rein In The Reits Acorn Canada

Types Of Real Estate Investment In Canada Mainstreet Equity Mainstreet

Potential Tax Benefits Of Investing In A Reit Skyline Wealth

What Is A Real Estate Investment Trust Canadian Real Estate Wealth

Reits Explained For Canadians Real Estate Investing For Beginners Passive Income Investing Youtube

Reits Canada Still Offers Tax Advantages For These Investments

5 Best Canadian Reits For 2022 Why We Invest In Reits Tawcan

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

Pdf Shareholder Taxation And Valuation The Case Of Canadian Reits

Understanding The Reit Taxation Rules Novel Investor

The Taxman Cometh A Look At The Tax Efficiency Of Reits Nysearca Vnq Seeking Alpha

Distributions And Income Tax Information Proreit

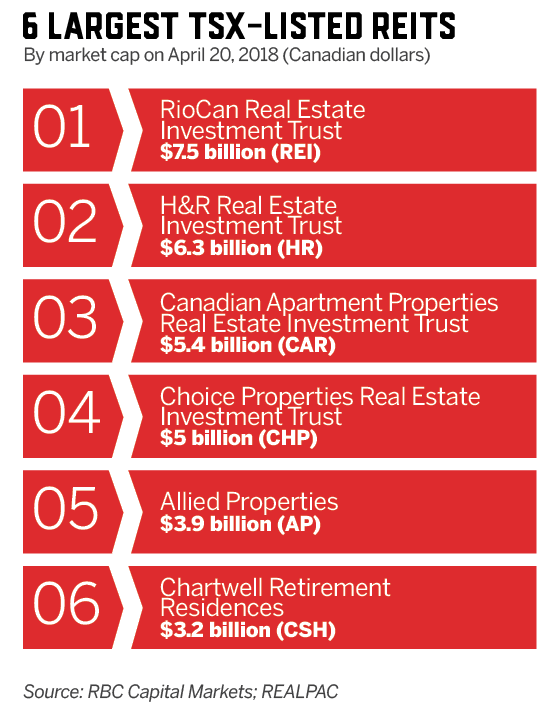

Canada S Reit Industry Turns 25 Nareit

Best Canadian Reits 10 Reits To Consider In 2022